New NJ Mansion Tax Explained! What Sellers in Tenafly Must Know

Eastern Bergen County Real Estate Market Update

Welcome back to your go-to source for all things Eastern Bergen County real estate. Today we’re diving into key updates that will impact both home sellers and buyers in Tenafly and surrounding areas, including a breakdown of the new Mansion Tax bill in New Jersey, what it means for your home value, and how it could shift the market.

We’re also celebrating strong home value appreciation in Tenafly, and yes, we’re throwing in a little summer fun with our Grill, Snap & Win BBQ Contest (details below ).

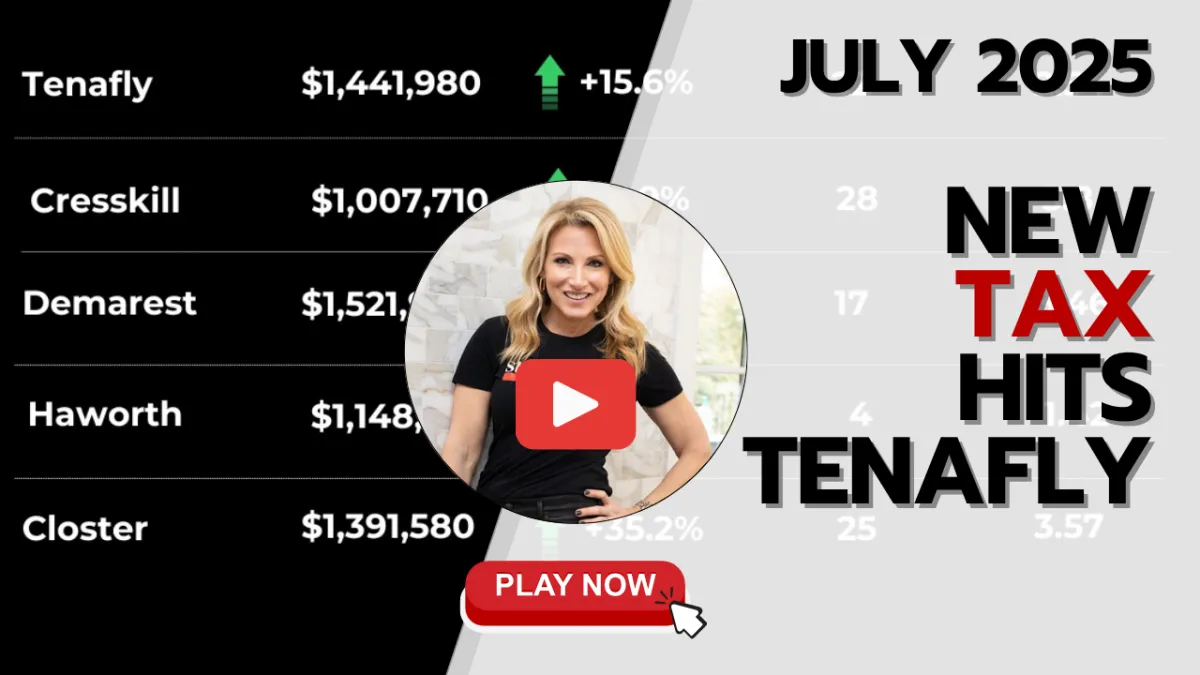

Tenafly NJ Home Values Continue to Rise

The real estate market in Tenafly remains strong. Median estimated values are climbing, and over 50% of homes sold in the last 12 months were priced over $1 million. Despite national slowdowns, Eastern Bergen County is bucking the trend with double-digit appreciation and continued buyer demand.

But a big change is here—and it could shift how deals are made going forward.

What You Need to Know About New Jersey’s Updated Mansion Tax (Effective July 2025)

One of the most significant real estate updates in New Jersey this year is the revision to the mansion tax, which disproportionately impacts high-value markets like Tenafly.

Quick Overview: What Changed?

Old Law:

Buyers paid a 1% mansion tax on any home over $1 million

Sellers paid a separate realty transfer fee

New Law (Effective July 2025):

Sellers now pay the mansion tax

The tax is now tiered, depending on the sale price

This also applies to commercial properties, meaning the financial impact could be significant for both developers and investors.

What This Means for Tenafly Homeowners

More than half of all homes sold in Tenafly exceed $1 million, so this new law is not just targeting ultra-luxury homes, it’s targeting everyday real estate in Eastern Bergen County.

Key Takeaways:

Sellers are now footing the bill, not buyers

Many sellers may raise their listing prices to compensate

This may push prices even higher across all price points

It could reduce seller motivation, resulting in fewer new listings

Buyers may benefit from not paying the tax, but still face rising prices

For homes already under contract over $2M, sellers will temporarily pay the elevated tax and must apply for a refund during tax season (as long as the deed is recorded by November 15).

Local Market Snapshot: What Else Is Happening?

Price Reductions are increasing, signaling seller pushback

Days on market are up slightly, but prices still rise in many cases

Expired and withdrawn listings are climbing, a clear sign that if sellers don’t get their number, they’re stepping back

New listings are down, adding more pressure to already tight inventory

Bottom line? Sellers still have leverage, but they’re getting more selective. Buyers need to be prepared to move quickly when a well-priced home hits the market.

Join Our “Grill, Snap & Win” Summer Contest!

We’re keeping it fun this July with a barbecue-themed photo contest just for our amazing community!

How to Enter:

Snap a photo of your BBQ masterpiece—food, grill, or chef-selfies welcome

Submit as many photos as you’d like

You’ll be entered to win a 6-month Gold belly BBQ subscription (curated by yours truly)

Just scan the QR code on our Instagram or reach out via DM for full contest details!

Final Thoughts: Tenafly & Eastern Bergen County in Transition

The new mansion tax in NJ is more than a headline—it’s a structural shift that could drive prices higher, stall inventory, and increase buyer frustration. But if you’re prepared, it can also be an opportunity.

Whether you're buying, selling, or holding, a customized strategy session can help you navigate the changes.